PropNex Picks

|November 13,2025Loss and Property Inheritance

Share this article:

The house hasn't changed much.

Slippers by the front door are still in disarray, newspapers are still piling on the coffee table, and the wind chimes still tinkle by the window. But no one has flipped the hanging calendar in a while. Every corner seems frozen in time, even as life outside keeps moving.

In the midst of your grieving, calls start coming in. Lawyers, banks, maybe even an HDB representative. When a loved one passes on, no one prepares you for how complicated inheritance can be. It's not something most of us think about until it happens, but someone has to take care of what's left behind.

While you take time to heal, life's practical matters can't wait forever. The more time passes, the more questions you have. Do you keep the house? Sell it? Move in? It's a decision that not only carries emotional weight but also financial implications. So while this article can't answer every question or ease the ache of loss, we hope it offers a first step toward understanding and managing your inheritance.

When someone passes away, their property doesn't automatically transfer to their next of kin. The property becomes part of what's called the estate (everything that the deceased owned - money, property and assets), and it must go through a legal process before it can be sold, transferred, or inherited.

What happens next depends mainly on two things:

- Whether the person left a valid will, and

- How the property was owned (solely or jointly).

If there is a will, the person named as executor (the one chosen to handle the estate) must apply to the court for a Grant of Probate. This legal document gives them the authority to manage and distribute the estate according to the will.

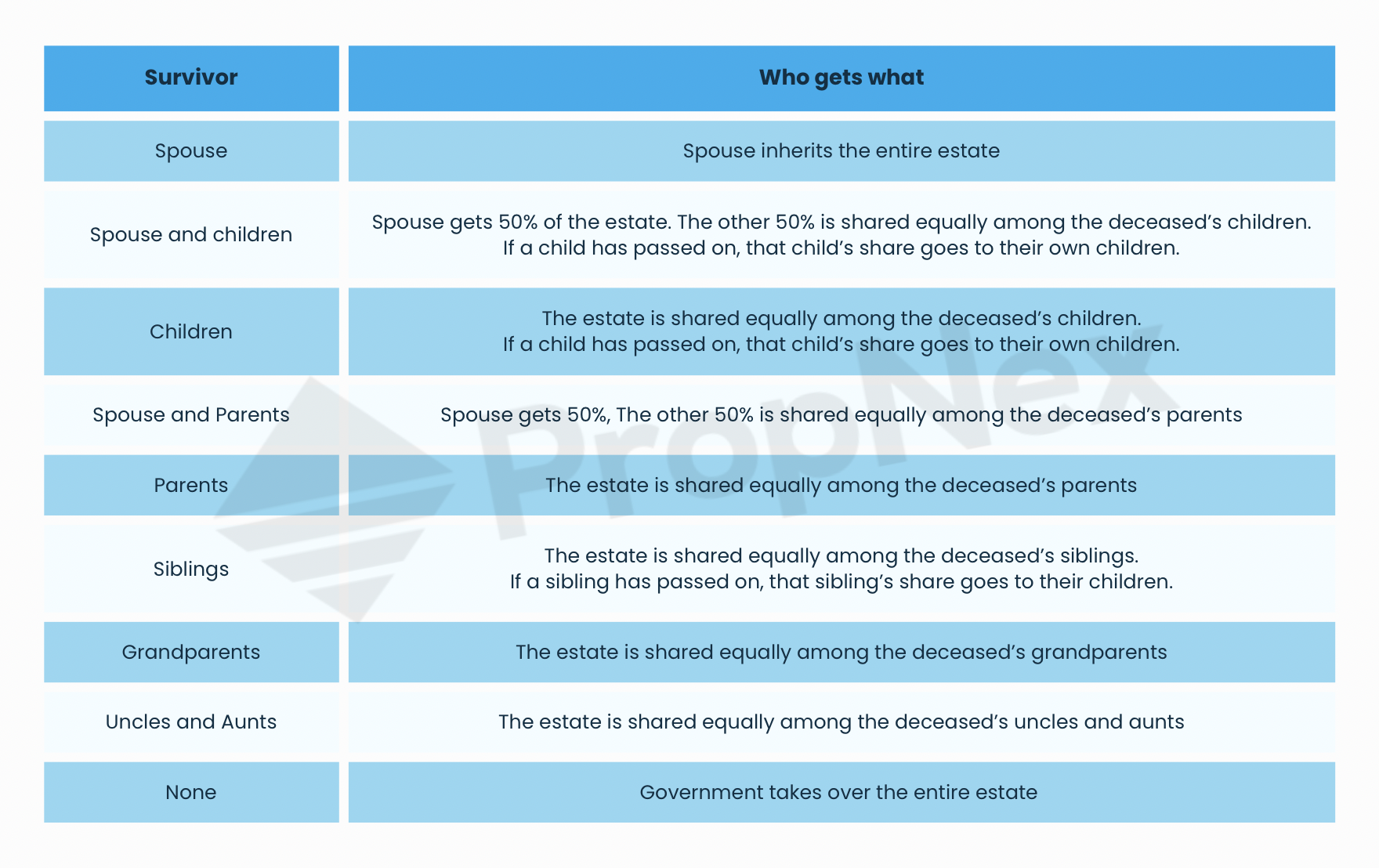

If there's no will, the family must apply for a Grant of Letters of Administration. This lets a next-of-kin manage the estate, which will then be divided according to the Intestate Succession Act (the law that decides who inherits what). Below are the details.

That said, do note that the Intestate Succession Act does not apply to Muslims. The estate of a deceased Muslim is distributed under Muslim Inheritance law (also known as the 'faraid') and the Syariah Court.

For jointly owned property, things are simpler. The surviving co-owner automatically inherits the property through what's called the right of survivorship. That means the home does not become part of the deceased's estate.

However, for sole ownership, the property cannot be transferred, rented out, or sold until the court grant (probate or administration) has been approved. This process can take several months, depending on how complex the estate is.

Fortunately, Singapore abolished estate duty in 2008, which means you don't have to pay inheritance tax when you inherit a property. However, that doesn't mean inheriting property is entirely cost-free. Beneficiaries may still face several financial obligations, such as:

Legal fees

You might need to pay some legal fees for probate or administration.

Maintenance costs

Whether it's an HDB flat or a condo, there'll always be some form of upkeep cost. For HDB, this comes as Service and Conservancy Charges (S&CC), which can range between $20 to over $100 depending on your situation. For condos, maintenance fees can go even higher, even reaching 4 digits at times. And they typically collect these fees every quarter!

Property tax

Property tax is payable every year. This applies to both residential and commercial properties.. The amount is calculated based on the property's annual value, and it's progressive, meaning higher-value homes are taxed at a higher rate. IRAS also makes a distinction between owner-occupied homes and non-owner-occupied ones. If you're staying in your own place, you'll enjoy a lower tax rate. For the latest rates, it's best to check directly on the IRAS website.

Stamp Duties

If the property is a residential property and is inherited via a valid will, or under the Intestate Succession Act or the Muslim Inheritance Law, then stamp duty typically does not apply.

However, and this is the important part, if the inherited property transfer is treated as a gift or sale, rather than a simple inheritance, then stamp duties may apply. You can also attract stamp duties in other ways.

For example, let's say the property was bought a year before you inherited it. If you decide to sell it immediately, then you'll have to pay Seller's Stamp Duty (SSD), since it still falls within the minimum holding period.

On the other hand, if you choose to keep the inherited property and later decide to buy another home, you will have to pay Additional Buyer's Stamp Duty (ABSD) on your new home.

Inheriting a property isn't just about being named in a will. Certain situations can influence whether or not you can keep the inherited home. For example:

- If you already own an HDB flat, you cannot keep an inherited HDB flat. This means you need to sell one or the other within six months.

- If you already own a private property, you cannot keep an inherited HDB flat that was purchased after 30 August 2010. If the flat was purchased before then, the MOP must be met. If not, then you have to live in the inherited flat.

- If you're a foreigner inheriting a private property, you need to get approval from Singapore Land Authority (SLA) to keep it.

- If you're a Singapore citizen inheriting a private property, but you already own an HDB flat, you need to meet the MOP to keep the inherited property.

- If the property still has an outstanding mortgage, the bank will need to assess your Total Debt Servicing Ratio (TDSR) to determine if your income qualifies you to take over the loan. Many assume TDSR only applies when buying a property, but that's a common misconception. If the property owner passes away before paying off the loan, the bank must ensure the beneficiary meets TDSR limits before approving the transfer. So basically, if your income doesn't meet the required ratio, you won't be able to take over the mortgage, and therefore, you won't be able to inherit the property at all, even if it was legally willed to you.

When you're still in mourning, the process of settling a property can feel overwhelming. So it's helpful to do things step by step. Here's a guide that you can follow.

- Locate the will (if any) and identify the executor or administrator

Find any will, a copy of the property title, mortgage documents, and important personal papers. If there's no will, the next-of-kin must apply to be the administrator through the court. - Apply for the court grant, either Grant of Probate or Grant of Letters of Administration

If the estate is solely owned by the deceased, the executor/administrator will need to apply to the Family Justice Courts for a Grant of Probate (if there's a will) or Grant of Letters of Administration (if there's no will). This grant gives legal authority to deal with assets, pay debts, and transfer property. - Notify the relevant agencies and institutions

Once the grant application is underway or granted, notify parties that need to be informed and may place holds on accounts or assets:

- HDB: If it's an HDB flat, you should inform HDB. They can then advise you on eligibility to retain the flat, required documents, and any sale timelines.

- SLA/Land Titles Office: For private property, the transfer of title is handled by SLA after probate matters are cleared.

- IRAS: Inform Inland Revenue to sort out tax matters and refunds (e.g., CPF refunds that must be made to the estate before distribution).

- Banks/Mortgage Lenders: Notify banks about any outstanding loans. They will advise on loan repayment, transfer, or refinance options.

Town Council/MCST/Management Office: Alert whoever collects conservancy or MCST fees so bills don't pile up.

Notifying these bodies early avoids frozen accounts, accruing fees, or delays that can complicate estate administration.

- Assess the property

Take note of the property's legal status and practical condition, such as outstanding mortgage and remaining lease. While you're at it, get a property valuation and an estimate of renovation or upkeep costs to help you make an informed decision later on. Talk to your family and reach a plan

If your family can come to an agreement right away, that's wonderful. But it's not uncommon for family members to have disagreements when settling an inheritance, since they might have different wishes, sentimental ties, or financial needs.So try to have an open conversation covering different options and timelines. Some families choose to keep the home as a shared property or rental investment. Others decide to sell it and split the proceeds to move forward. Beyond the emotional considerations, also think about how the property fits into your family's long-term goals and financial wellbeing.

Remember, there's no right or wrong choice. What matters is reaching an agreement with everyone involved. And when that happens, put your agreements in writing. If possible, get them witnessed or formalised to prevent misunderstandings later.

If there are disagreements, try mediation or family conference first. If that fails, legal action may be necessary. However, legal disputes can be costly and slow, so do keep that in mind.

Decide and act: keep, rent, sell, or redistribute

Once the legal and emotional dust settles, it's worth taking a step back to reassess your family's agreement. Ask yourselves what the property means for your family's future. Can it be an asset that continues to grow in value, or a stepping stone for the next generation's housing plans?If everything looks good, you can proceed as below.

- Keep: prepare a budget for maintenance, property tax, insurance and any renovations.

- Rent out: research rent prices for similar properties in the area and start looking for tenants.

- Sell: engage a real-estate agent familiar with inherited properties and check for stamp duty and other implications.

- Buy-out: if one beneficiary buys out others, formalise the transfer with legal documents and factor in stamp duties.

Saying goodbye to a loved one is never easy, and it can be overwhelming to deal with what's left behind. But beyond the grief, there are legal steps to take. And once those legalities are sorted, the real work begins: deciding whether to keep, rent out, or sell the home.

Alas, there's no one-size-fits-all answer. You have to take the time to reflect on how this home can serve your family's future. And whichever route you choose, make sure it aligns with your family's goals and circumstances.

Don't forget that it's okay to ask for help. With the right guidance, you can learn how to manage what's been passed on with care so your loved one's legacy can continue to shelter and support your family.

If you'd like to understand how inherited properties can fit into a broader wealth plan, explore the Property Wealth System (PWS) here.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.